How to Stop Overspending and Feel Good About Money

Do you ever feel like you’re working hard but never seem to get ahead financially? Maybe you promise yourself you’ll “do better next month,” only to feel frustrated when the same spending patterns keep showing up.

If you’re wondering how to stop overspending, you’re not alone—and you’re not failing. Overspending is often less about willpower and more about awareness, emotion, habits, and intentionality.

So don’t feel bad if you’ve found yourself spending more than you want or should. It doesn’t mean there’s anything wrong with you and you can absolutely change the way you spend.

Here are 11 gentle strategies to help you understand your spending, make intentional choices, and feel more confident about your money.

How to Stop Overspending Strategies

1. Understand Your Spending

Overspending happens for many reasons—stress, boredom, emotional triggers, habit/routine, or even comparison. Sometimes, it starts with small purchases that feel harmless, but over time they add up and create stress, anxiety, or guilt. They can even make it harder to feel financially secure or harm your ability to do the things you most want to do in life.

The first step is to figure out why you spend money. Instead of judging yourself, get curious:

Are you spending to soothe stress or fill an emotional gap?

Do you shop when you’re tired, lonely, or overwhelmed?

Are your purchases tied to wanting to feel “caught up” or “enough”?

Do you spend money to celebrate or because you feel you deserve something?

Awareness is the first step toward change. Once you understand the underlying reasons for spending, you can start building new coping strategies that feel supportive rather than restrictive.

Try this:

Think about the times when you’ve spend too much money or purchased things that you later regretted. Often, there is an underlying emotional reason for shopping or spending money. Spend some time reflecting on or journaling about how you were feeling and how you wanted to feel.

Remember to be gentle with yourself! This process might bring up strong emotions, but it’s an important step in moving forward.

2. Identify Specific Spending Triggers

The next step in gaining more control of spending is to know your spending triggers. What are the exact times, situations, habits, or circumstances that lead you to spend money? Sometimes these tie into the underlying emotions or reasons for spending, but often they are more specific and tangible.

Examples of Spending Triggers

(No judgement if these sound like you—they absolutely happen to me too.)

Getting an email with a discount to your favorite store

Going to Target as an activity to get out of the house

Scrolling social media or shopping online when you’re bored

Distraction from a hard day, bad news, or what’s going on in the world

Going out to celebrate even small wins

Feeling like you deserve a little treat

Buying extra food when shopping while you’re hungry

Eating out or going shopping when you need social interaction

None of these things are necessarily bad as long as you plan for them. But if they’re causing you financial stress, it’s important to be aware of what’s triggering you to spend money.

Try this:

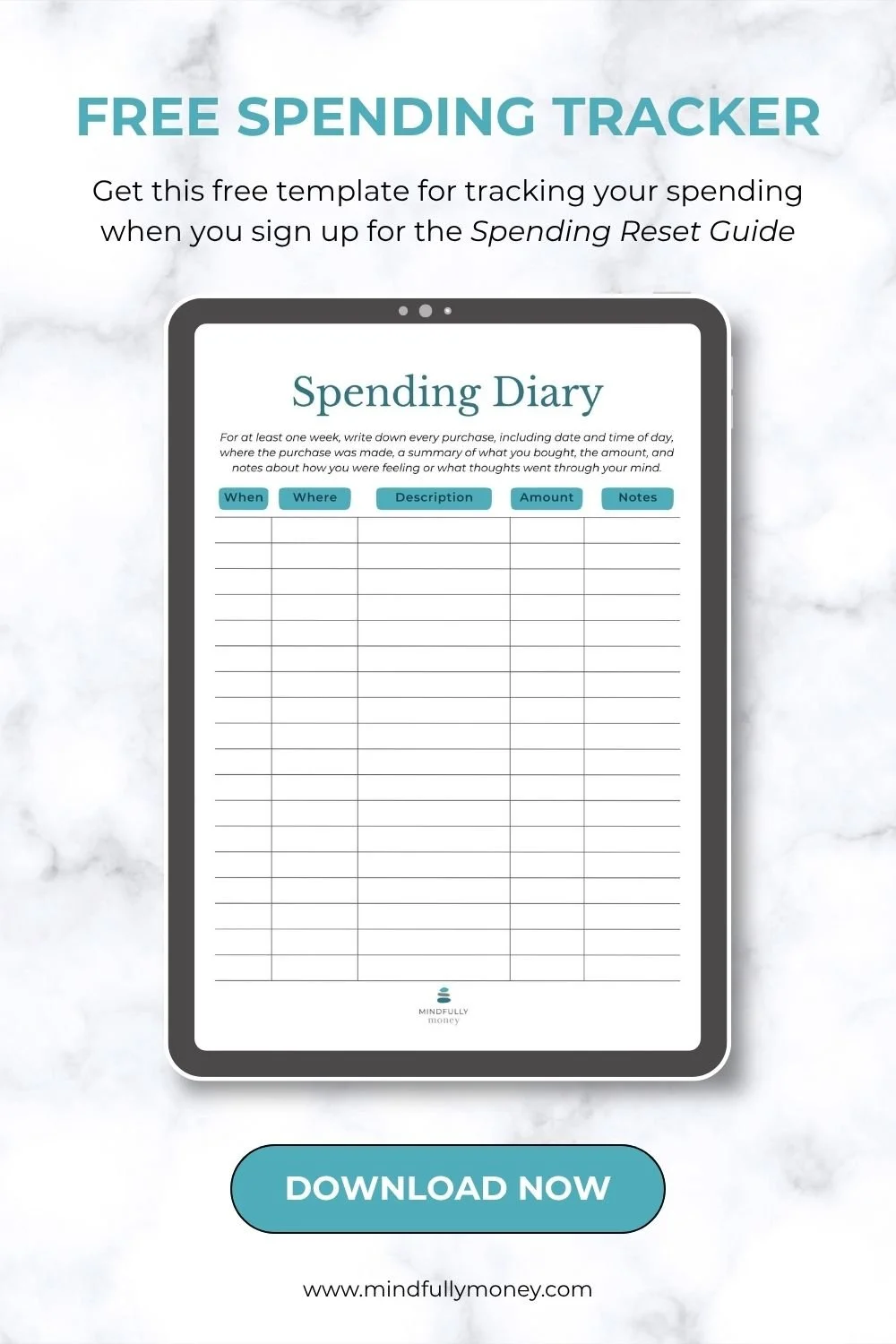

Track your spending for a few weeks (or even a few days), recording details like how you felt, where you were, what you bought, and why you bought it.

While apps and online banking tools can show you where you spent, writing it down as it happens with these extra details can give you a deeper level of awareness. Learn more and get a worksheet for tracking your spending by downloading my free Spending Reset Guide.

3. Avoid Your Spending Triggers

Once you know what’s causing you to spend, you can make a plan to avoid your triggers. Avoiding them is much easier than trying to say no to yourself in the moment.

Try this:

Unsubscribe from store emails offering discounts

Avoid your favorite stores

Order groceries online (to reduce impulse purchases)

Don’t to the store when you’re hungry and/or tired

Plan meals and have ingredients on hand to reduce the need to go out to eat

Search for free activities to fill your time.

Identify things you can do with friends that don’t involve spending (as much) money

Make a list of things you could do when you’re feeling bored or need comfort

Go for a walk, do yoga, or find other ways to destress and care for yourself

Instead of scrolling on your phone, play games, read a book, or learn something new instead of shopping or scrolling mindlessly

4. Make it harder to buy things

Making it harder to spend money is a great way to interrupt your brain’s normal default patterns. Companies have been making it easier and easier to spend money with one-click purchases and faster checkouts because they know it makes people more likely to buy. You can use this same principle in reverse by increasing the effort required to make a purchase.

Try this:

Delete your credit card information from your phone and online accounts

Freeze your credit card in a block of water or lock it up in a safe

Use cash only

Anything you can do to increase the effort reduces the chance that you’ll spend.

5. Use Time to Your Advantage

One of the most successful things I do to keep myself from impulse buying is wait before purchasing. Giving myself a few days to evaluate helps me know if something is an emotional or impuslse purchase or if it really is something that I truly want. More often than not, I forget about the item entirely.

Try this:

Add things to your cart (or leave it in the store) and tell yourself you can come back and get it in a few days if you still want it.

Learn more about this strategy in the free Spending Reset Guide.

6. Plan Ahead

One of the most common reasons for overspending comes from not having a plan. Anytime I go to the store without a list or a specific plan, I come home with all sorts of things I probably didn’t need.

A little preparation—like meal planning or keeping a list for the grocery store—reduces “emergency” or impulse spending and helps you stay intentional. For example, make a list of a few meals you could easily and quickly pull together when you don’t have time (or energy) to cook. Keep the ingredients on hand so you don’t have to stop at the store.

It’s not about discipline or giving up things you want—it’s about giving yourself structure and systems that help you stay on track.

Try this:

Identify times when lack of planning has led to overspending. Make a plan in advance for how you could handle those situations, especially when you’re tired or overwhelmed.

7. Identify What’s Most Important

When life is busy, it’s normal to go through your days buying whatever seems to make sense at the time without much thought. You go to the grocery store and grab things you want. You go to Target or Walmart and buy things that catch your eye. Most of the time, we don’t really think about how any particular purchase affects our larger financial picture.

This is completely normal and understandable, but it can often result in getting to the end of the month, wondering where all the money went and wishing we had more for things we really, truly want in life.

In order to break this cycle, it helps to identify what areas of life are truly important to you. What are your values? What do you want most out of life?

Then start asking yourself how each purchase aligns with your priorities.

“Does buying this one thing mean I’ll have less for something that’s more important to me?”

“Does this item contribute to making my life better based on what I care about the most?”

Intentionally spending in alignment with your values can help you reduce mindless purchases while simultaneously increasing your sense of happiness and fulfillment in life.

Try this:

Download my free Identify Your Values Workbook to explore what’s most important to you in life.

Make a list of your specific goals and consider how each relates to your life values.

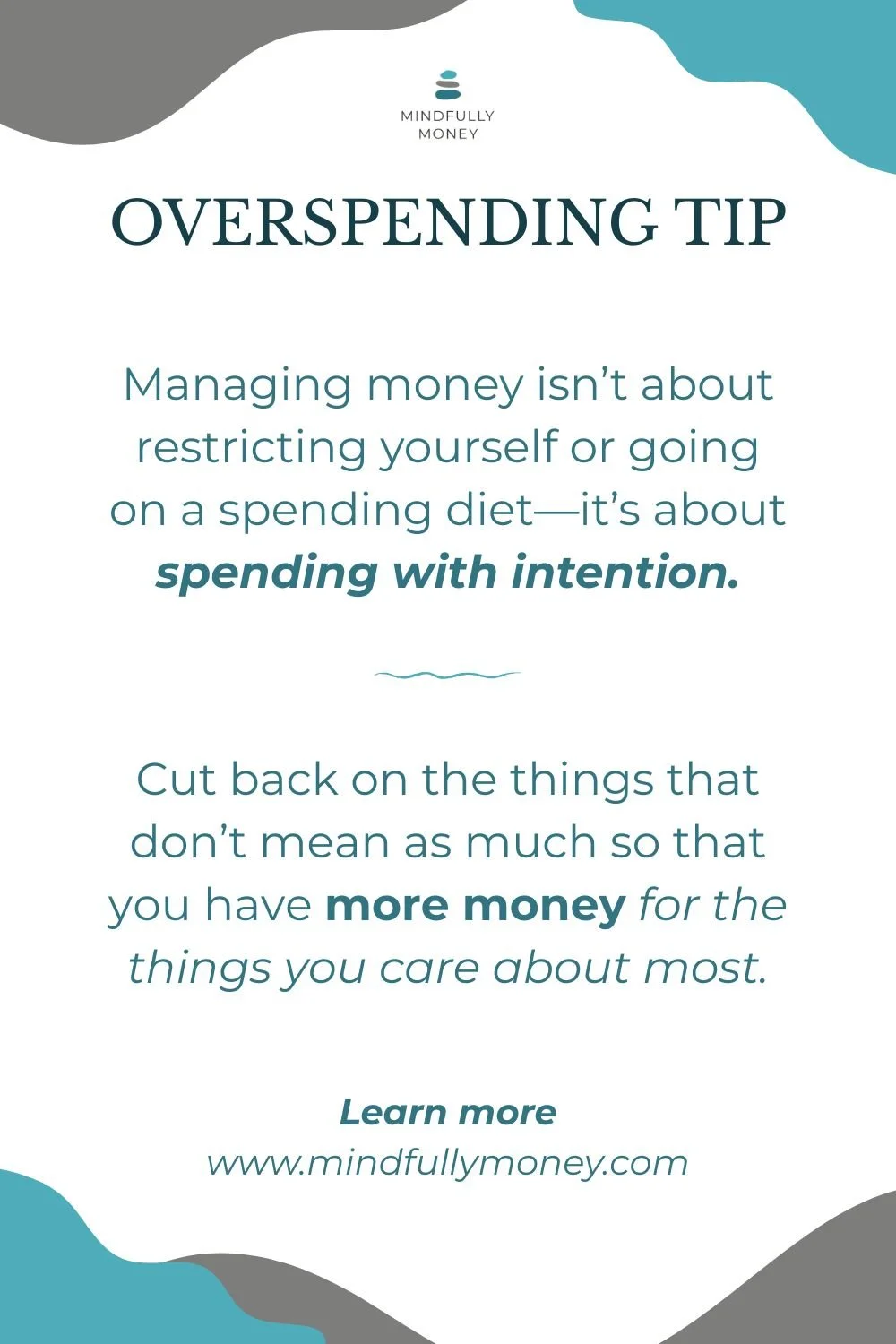

Cut back on things that don’t support your goals and values so that you have more money for the things you care about the most.

8. Keep Your Priorities Front and Center

It can be challenging to focus on what is important to you when you’re at the store with something you want staring you in the face. It’s natural for humans to be distracted by things in the present and abandon or forget something they want in the future.

That’s why it is helpful to create reminders to help you maintain your focus on your priorities. Anything you can do to create reminders of your values and goals will help you reduce spending on less meaningful items.

Try this:

Make a vision board of your goals (a trip, financial peace, time freedom).

Add a sticky note to your credit card with a reminder like “Does this align with my goals?”

Keep a photo of something meaningful in your wallet or phone background.

These small reminders keep your long-term goals visible when short-term temptations arise.

9. Calculate Your Opportunity Cost

Every time you spend money, you are giving up something else—the opportunity to buy something else, the time you spent working to earn that money, the chance to do or purchase something in the future.

Figuring out the opportunity cost (what you’re giving up) can be a helpful way to make more intentional spending decisions.

Try this:

Calculate the number of hours you had to work to buy an item

If there’s something you really love to buy (lattes, shoes, golf trips, whatever), think of the item you’re considering it terms of how many of those things you could purchase. (For example, if I buy a $100 sweater, I’m giving up 12 lattes.)

It’s okay to spend on things you enjoy, but sadly we can’t buy everything we want all the time. So be intentional and spend your money on the things you want most while cutting back on the things you care about less.

10. Automate Saving

Set up automatic transfers to savings or investments so the money moves before you can spend it. You can’t spend what you don’t see.

Automation helps you follow through on your intentions without having to think about it.

Try this:

Set up a high yield savings account, ideally at a different bank so you don’t see the money every time you log in to your checking account. Set up an automatic transfer to this account right after you are paid.

11. Practice Gratitude

One of the best ways to reframe your mindset is to focus on what you already have instead of fixating on what you don't.

Try this:

Grab a notebook or journal and write down 1-3 things that you’re grateful for each day. When you feel down about life or find yourself wanting things you don’t have, take a look at what’s in the journal to reset your perspective.

12. Use Two Checking Accounts

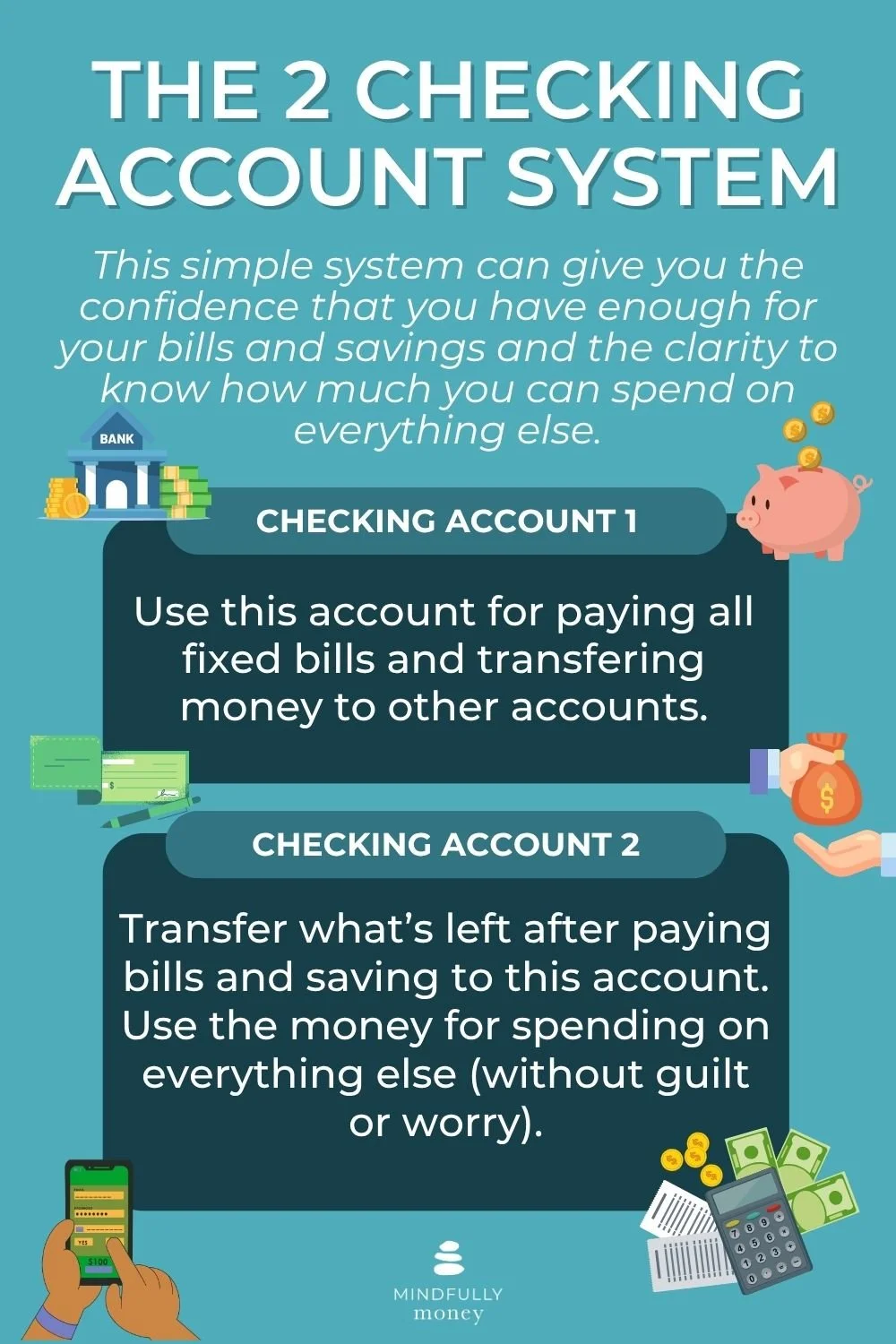

I often recommend that my clients use two checking accounts to manage their money: one for bills and fixed expenses and one for spending. Reserve enough money in the bills account to pay for your rent/mortgage, utilities, and all of the other predictable bills (including money you want to send to your savings account). Send what’s left to a separate account for spending on everything else.

What this does is gives you a clear picture of how much you have available to spend and you don’t have to worry about having enough for bills that get paid later in the month. Simply seeing how much you can spend is often enough to give you a greater sense of control. (No more “I have no idea, so I’m just going to buy things and hope for the best.”)

Try this:

Open a second checking account.

Add up your bills/fixed expenses. Keep enough money to pay for all of them in your account.

Transfer the rest to a separate account for all other spending.

13. Get Support

If you’ve tried to stop overspending on your own but feel stuck, you don’t have to do this alone. A supportive partner, friend, or financial coach can help you stay accountable and uncover emotional patterns around money.

(If you’d like guided reflection questions and practical tools to help, download my free Spending Reset Guide. It’s a gentle first step to reconnect with your money and start spending with intention.)

Embrace a New Mindset

Learning how to stop overspending isn’t about restriction—it’s about self-awareness, alignment, and choice. Progress comes from small, consistent steps and a lot of self-compassion along the way.

Celebrate every win, even tiny ones. The more you practice, the easier it becomes to spend intentionally, save consistently, and feel confident about your financial future.

You don’t need to be perfect. You just need to build awareness and keep showing up for yourself—and that’s exactly where lasting change begins.